Corporate gift-giving is a standard business practice, but it's essential to understand the laws and rules that govern it. Gifting inside your company and gifting outside of it each come with their own set of considerations.

When giving business gifts internally to employees, it's important to consider tax laws in addition to company policies, favoritism, and the overall code of conduct. You should determine whether the gifts are taxable income that you must report to the IRS or whether they are considered de minimis fringe benefits and, therefore, non-taxable. (More on that below.)

Sending gifts outside of your company (such as client gifts) introduces additional concerns around rules governing bribery, industry-specific regulations, and social etiquette. In addition to legal and ethical considerations, it's essential to choose appropriate tokens of appreciation that will have the desired impact on your business relationships.

The good news is that, in most cases, sending or accepting gifts should not cause legal or compliance headaches. While following rules and regulations, companies can also aim to give meaningful and memorable gifts to employees, business associates, clients, and partners.

Continue reading for tips on how to succeed in corporate gifting.

Disclaimer: While this article was written using the IRS’s most recent guidance, it does not constitute legal advice. Always consult a legal expert to determine your exact taxation and reporting requirements.

Tax Laws for Corporate Gifting

Giving gifts can be enjoyable, but running afoul of the law is not. Understanding tax laws for corporate gifting is vital to ensure everyone stays out of trouble.

The Tax Implications of Employee Gifts

Giving gifts to employees is an effective way to boost morale and demonstrate care for your staff. However, corporate gifting can sometimes result in the employee being responsible for claiming the gift on their taxes, depending on the type of gift and its nominal value.

There are rules to follow when giving a gift, and the most important is that the gift should have a low fair-market value, typically under $100. Some legal experts recommend setting the limit at $75.

Are employee gifts considered taxable income?

Physical gifts to your staff under $100 in value are typically considered a "De Minimis Fringe Benefit," which is a gift that is so small or infrequently given that it would be unreasonable or impractical to claim it on taxes.

Examples of items that are typically considered De Minimis Fringe Benefits include occasional lunches or morning donuts, flowers, fruit, holiday gifts, or other presents given under specific circumstances, as long as the price of the gift does not exceed $100.

To stay within the De Minimis Fringe Benefit threshold, limit gift-giving to special occasions such as holidays, birthdays, or work anniversaries. This approach also simplifies gift tracking, which is necessary if you want to deduct some of the gift costs from your corporate tax returns.

It's worth noting that there's a significant exception to the de minimis rule: cash and gift cards are always considered taxable income, regardless of the amount. Therefore, it's generally better to give unique and thoughtful physical gifts for your employees – to avoid saddling them with a tax bill for your generosity.

Are employee gifts tax-deductible?

Yes! Each year, you can deduct up to $25 per employee for gifts on your taxes.

That means if you give an employee a gift valued at $50, you can deduct $25 of the cost on your taxes.

If you give a gift to a group of employees, the $25 per person limit still applies. For example, if you give a $250 gift basket to a group of 10 employees, you could deduct $250 as a business expense, because the cost per person is still $25 or less.

Tax Implications for Client Gifts

When giving gifts to clients, the tax implications are a bit simpler – mainly because you don’t need to worry about gifts (even expensive gifts) becoming taxable income for the recipient.

With that said, the same rules still apply as far as deductions. You can only deduct up to $25 worth of gifts on your taxes per person. Note that if you and your spouse give a gift to the same person, you’re counted as one taxpayer.

It's worth noting that gifts under $4 with your company logo are exceptions to the $25 deduction limit because they are considered promotional material for your business.

Examples of these gifts include pens, keychains, tote bags, and other small items given to clients at events. Additionally, incidental costs like wrapping and shipping are not included in the $25 limit – so you can deduct those costs on top of your $25 gift expense (up to $100 total per person).

Top Tips for Employee Gifts

When giving gifts to your employees, there are still some things to consider before you buy.

1. Check With Your HR Team

Companies may have their own internal policies or regulations they need to follow in their industry. When in doubt about what you can and cannot give to employees, it's best to check with HR at your company to be safe.

2. Avoid Gift Cards

Gift cards – no matter the amount – are considered taxable income. To avoid the headaches of tax reporting or gifting a tax bill to your staff, it’s better to stick to physical gifts – which feel more personal and meaningful anyway.

3. Think Beyond Swag

At many companies, when it’s time for employee gifts, managers instinctively think: Let’s send some custom merch with our logo on it!

While branded swag can be a wonderful employee gift, particularly during onboarding, employers should consider gifts that feel more human and personal than company merch. Particularly during the holiday season, surprise your employees with gifts that you would send to a personal friend or loved one.

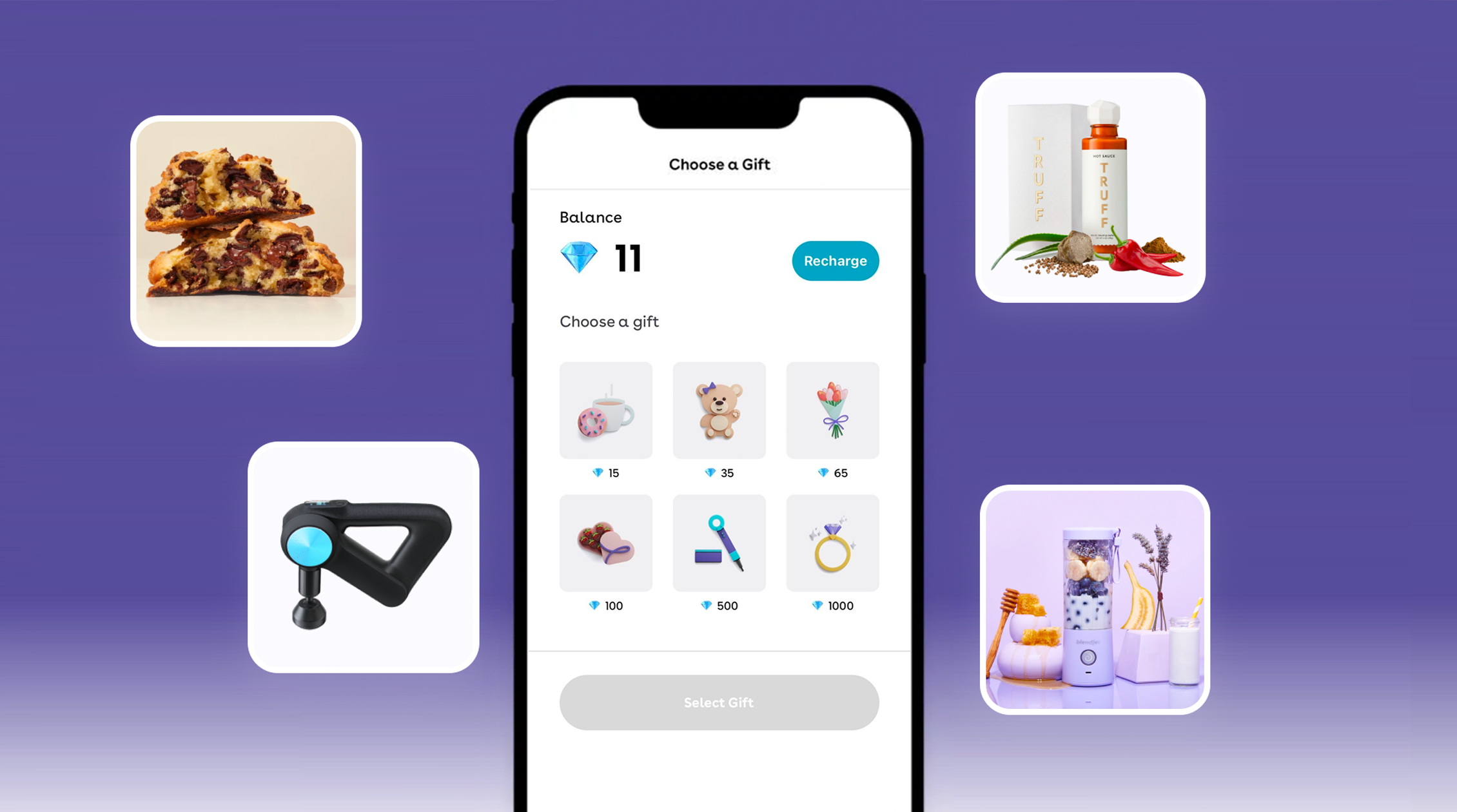

Here at Goody, we’ve curated 300+ unique and trendy gift brands like Levain Bakery, Graza olive oil, and Therabody wellness tech. You can even just set a price point and let your employees choose anything they’d like from our collection (with no gift cards shown). Sign up with Goody Business today and send your first unique gift for free.

Top Tips for Client, Sales and Business Partner Gifting

While the tax deductibility of client gifts is fairly simple, you should also consider the rules and ethical norms that govern external gifts in your industry.

1. Check Your Company’s Policies

Your company may have its own policies related to sales and client gifting depending on the type of business you’re in. In many industries, client gifts are loosely regulated, while in others, there are strict ethical and legal rules to follow. For example, gifts to physicians are highly regulated, and expensive gifts to government officials are generally unacceptable.

Even if there is no specific regulation in place, your company may have rules that it asks employees to abide by.

2. Don’t Be Afraid To Ask

Just as your company may have its own rules around gift giving, your clients may have their own rules around receiving gifts. If you’re in doubt, just ask your client if it’s OK!

3. Send Gifts They Can Swap (Especially Alcohol)

Think you know exactly what your client wants? Think again.

Here at Goody, we allow recipients to swap their gifts for options of equal or lower value. The numbers don’t lie: You should be humble about your gift-picking abilities. About 50% of the time, recipients will swap their gifts when given the option. That means senders guess wrong half the time!

This is particularly important for alcohol. A bottle of wine or spirits is a quintessentially classy client gift – yet 30% of Americans don’t drink, often for religious or health-related reasons. On Goody, a client can swap a bottle of Veuve Clicquot for something non-alcoholic (or perhaps a bottle of tequila).

How Goody Can Help

Goody’s philosophy is simple: There’s no reason that corporate gifts need to be any less delightful than personal ones.

Instead of offering generic, tacky, easily-forgotten gifts, Goody helps you offer personalized and engaging gifts that leave a lasting impression.

Goody offers a variety of gift collections that can be tailored to fit specific occasions and themes. Our gift options range from wellness to branded swag to food and drink, so there's something for everyone.

We also offer custom gift options, allowing companies to add a personal touch to their gifts and digital cards. By adding your company's logo or branding, your gifts become a representation of your company, making them all the more special.

Plus, our platform makes it easy to manage gift-giving events for large groups of recipients, with features like CSV imports, custom branding, and even HRIS integrations. On Goody, you can take care of 1,000+ gifts at the same time, and still include personalized messages in your digital cards.

Separate yourself from the pack of generic corporate gifters and show your thoughtfulness and creativity with Goody.

Sign up for free and start gifting today.

Sources:

De Minimis Fringe Benefits | Internal Revenue Service

Income & Expenses 8 | Internal Revenue Service

Gifts | U.S. Department of the Interior

.png)

.png)

%202.png)